tax shield formula for depreciation

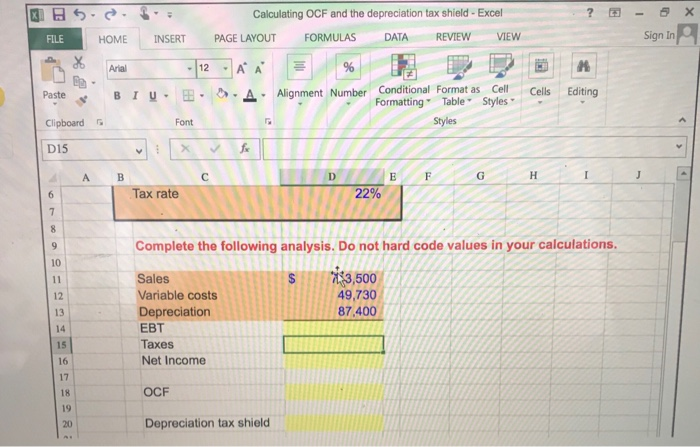

As you can see with this formula you can calculate how much you can shield yourself from taxes by leveraging your depreciation expenses. Depreciation Tax Shield Formula Depreciation expense Tax rate.

Interest Tax Shield Formula And Calculator Step By Step

A depreciation tax shield is a tax saved as a result of subtracting the depreciation expense from the income a business will pay taxes on.

. What is the formula for tax shield. The tax shield concept may not apply in some government jurisdictions where depreciation is not allowed as a tax deduction. In order to calculate the depreciation tax shield the first step is to find a companys depreciation expense.

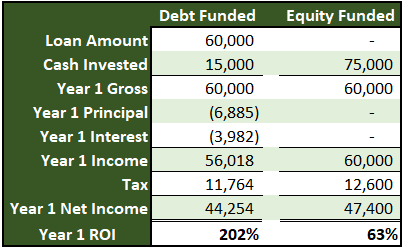

The effect of a tax shield can be determined using a formula. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest. Thus if the tax rate is 21 and the business has 1000 of interest expense the tax shield value of the interest expense is 210.

Interest Tax Shield Definition The value of a tax shield can be. How are tax shield benefits calculated. The company will use the straight-line method.

Depreciation as a Tax Shield The term tax shield refers. Depreciation Tax Shield Formula. Depreciation is considered a tax shield because depreciation expense reduces the companys taxable income.

All you need to do is multiply depreciation expense for tax purposes not financial purposes and multiply by the effective. DA is embedded within a companys cost of goods. The formula for calculating a depreciation tax shield is easy.

When a company purchased a tangible asset they are able to. Content Does Tax Shield Include Depreciation. Or the concept may be applicable but have less.

It can be calculated by multiplying the. To increase cash flows and to further increase the value of a business tax shields are used. To see how this formula is used.

The cost of the asset with a five-year life and zero residual value is 132000. Tax Shield Formula Breaking Down Tax Shield Can You Use Real Estate Depreciation To Offset Ordinary Income.

Depreciation Tax Shield Finance

Tax Shields Financial Expenses And Losses Carried Forward

Depreciation Tax Shield Formula Examples How To Calculate

Tax Shield Formula Step By Step Calculation With Examples

What Is The Depreciation Tax Shield The Ultimate Guide 2021

Why Do You Add Back Depreciation And Not Depreciation After Tax To Net Income When Calculating Fcff Doesn T Depreciation Create A Tax Shield Quora

Tax Shield Approach Meaning Depreciation And Interest Tax Shields

Tax Shield Formula Examples Interest Depreciation Tax Deductible

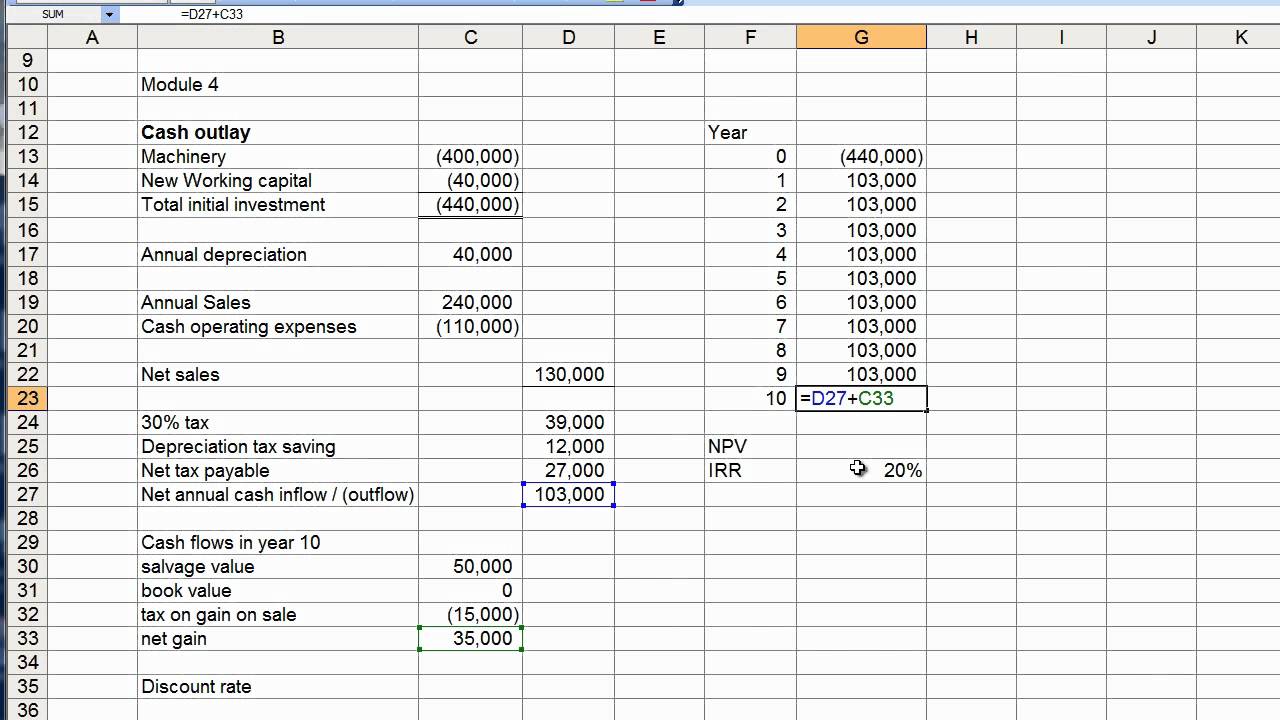

Solved Calculating Ocf And The Depreciation Tax Shield Excel Chegg Com

How Tax Shields Work For Small Businesses In 2022

What Is A Depreciation Tax Shield Universal Cpa Review

Double Declining Depreciation Calculator Calculator Academy

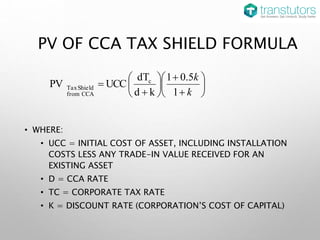

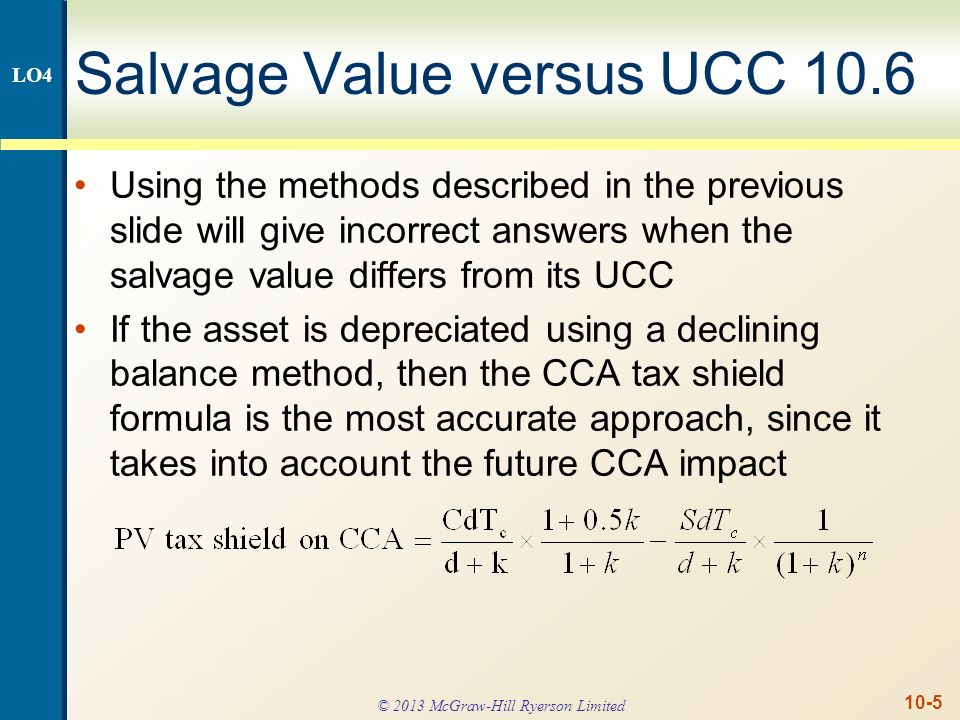

10 0 Capital Cost Allowance Cca Cca Is Depreciation For Tax Purposes The Depreciation Expense Used For Capital Budgeting Should Be Calculated According Ppt Download

10 0 Capital Cost Allowance Cca Cca Is Depreciation For Tax Purposes The Depreciation Expense Used For Capital Budgeting Should Be Calculated According Ppt Download

:max_bytes(150000):strip_icc()/DecliningBalanceMethod-9dd78f1fccd846d69ccea14c595645df.jpg)

Declining Balance Method What It Is Depreciation Formula

Tax Shield Formula How To Calculate Tax Shield With Example